A Taxing Problem for Amazon Associates in Minnesota

June 18, 2013 — by Per Christensson

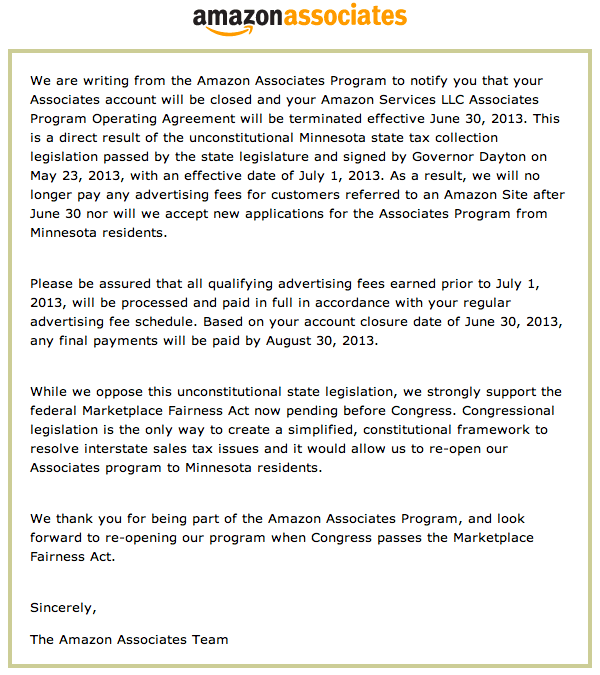

I woke up this morning to find this unfortunate email from Amazon in my inbox.

The email states that in less than two weeks – on July 1, 2013 – Amazon will be closing all the Minnesota-based Amazon Associate accounts. If you are an Amazon affiliate based in Minnesota, you are simply out of luck. Your account will be closed at the end of the month and there is nothing you can do about it.

Amazon is closing all Minnesota Associate accounts because Governor Dayton and the Minnesota congress have demanded new tax revenues from multiple sources beginning the second half of this year. One of those sources is Internet sales from retailers in other states.

This Minnesota-specific regulation means Amazon cannot maintain a profit on sales from Minnesota affiliates, since their margins are already so low. Amazon.com rightly stated that this law is unconstitutional as it prioritizes state demands over federal regulations.

I like most things about Minnesota, but the current state government is simply out of control. Instead of trying to use the current funds more efficiently, the government is demanding more tax revenue sources and higher rates than ever before. The Internet sales tax is just one of many new taxes introduced by the current administration.

Minnesota used to be one of the best states to run a small business. Now it's one of the worst. Fortunately for me, Amazon commissions are a minor part of my company's revenue. Other Minnesotans who've built their business around the Amazon Associates program are not as fortunate. They will either have to close their businesses or move to another state. They can thank Governor Dayton for driving them out of Minnesota.

Home

Home June 10th

June 10th