Why my Health Insurance Premiums are Increasing 56% Next Year

November 23, 2016 — by Per Christensson

My health insurance premiums are going up over 56% next year. It is the biggest annual increase in monthly premiums I have ever had – by far.

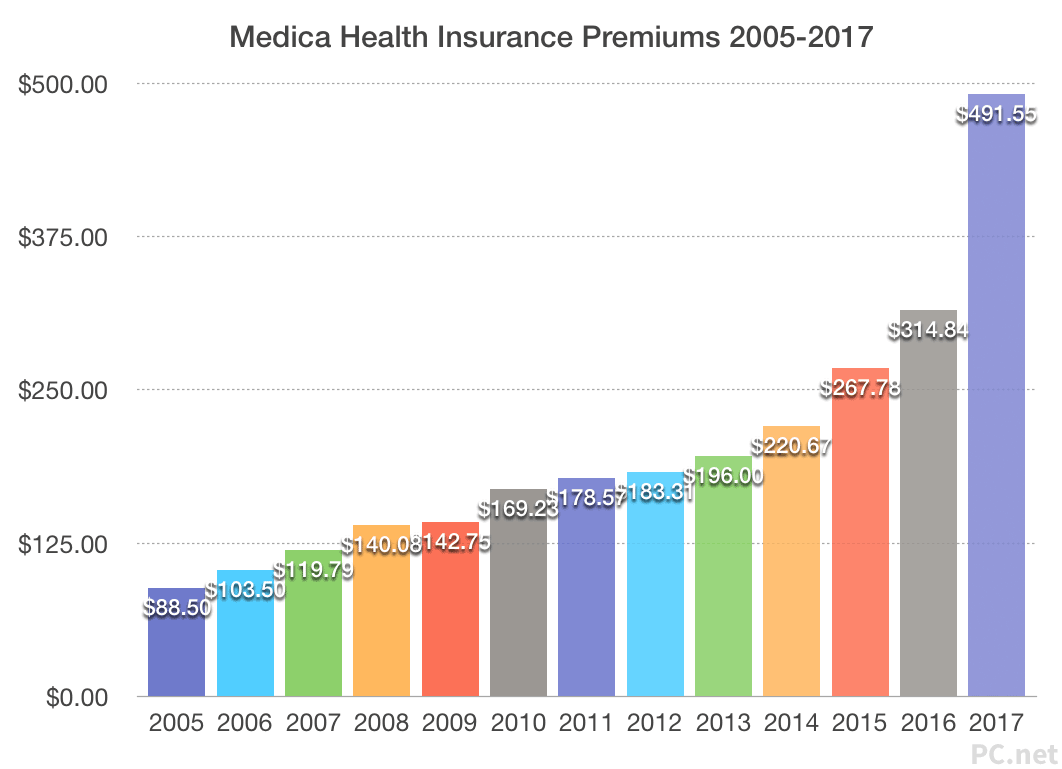

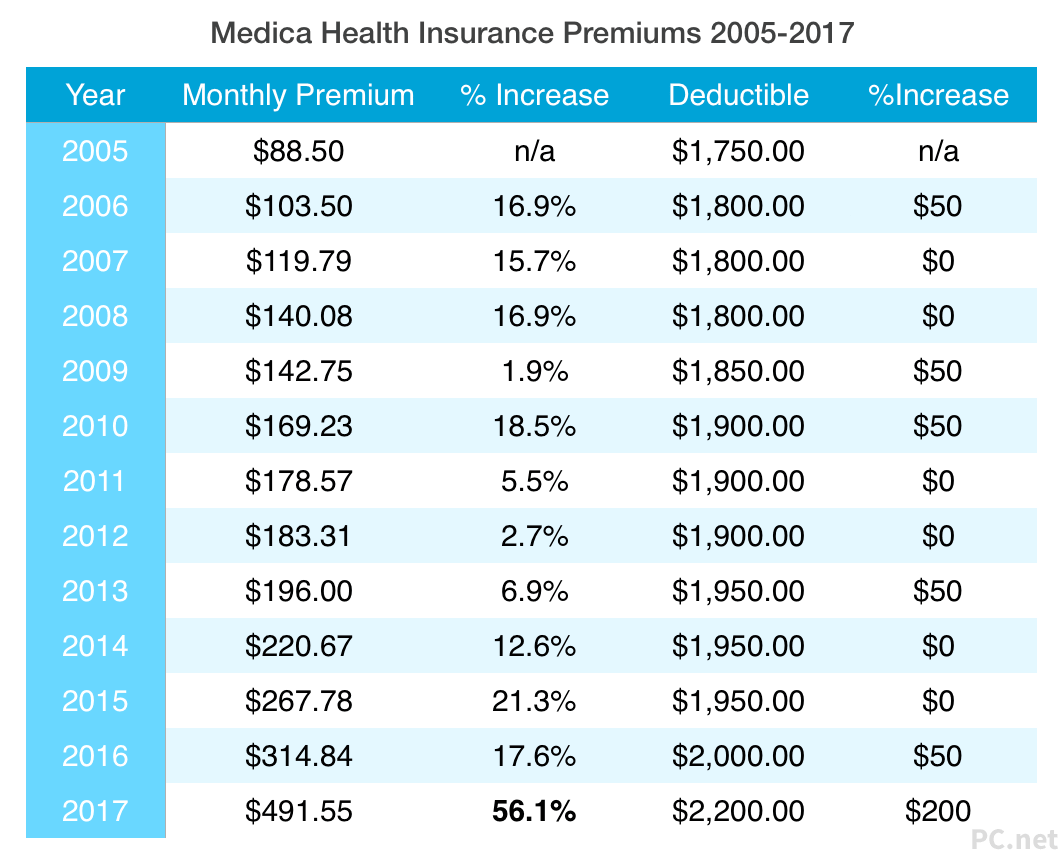

A few weeks ago, I surmised how Obamacare may have been a pivotal factor in the U.S. election. The Affordable Care Act (ACA) has driven up health care costs and has actually made health care much less affordable for most US citizens. It certainly has not benefitted me the past few years. See the chart of my 2005 to 2017 insurance premiums below.

The chart above speaks for itself. As the details of the Affordable Care Act have been implemented over past few years, I have watched my health insurance premiums skyrocket. On top of that, my insurance company – Medica – has reduced my coverage, lowered the amount they will pay for prescription drugs, and increased my deductible.

In 2017, I will be paying 455% or 5.5x more each month for my health insurance premium than I was paying in 2005. I realize I have gotten older and I understand that higher age means higher premiums. But a 455% increase is absurd.

Reasons Why Premiums are Soaring

So what is causing these runaway price increases? There are dozens of factors, but two of them stand out: 1) supply and demand, and 2) inefficiency.

I believe the people who created and supported the Affordable Care Act had good intentions, but unfortunately they were not economically astute. The ACA added a number of costs to the health care system without taking into account supply and demand. There are a relatively fixed number of hospitals, doctors, and other health care employees. So when you increase the number of people who have full access to medical providers and personnel, supply stays the same, but demand increases. The result? Prices increase.

Health care costs increase across the board, meaning medical device manufacturers, pharmaceutical companies, hospitals, and doctors can all charge more. And some of them need to charge more. The requirements placed on hospitals and doctors, for example, require them to spend more money. So they increase their prices to cover the costs. Insurance companies then have to pay more for medical services. And how do they cover their costs? Increase premiums.

Of course, insurance companies could combat increasing prices by running their businesses more efficiently. But they don't need to. The lack of competition in the health insurance industry is mysteriously absent, especially in a capitalist country like the United States. Health insurance companies have near monopolies in their own states and therefore do not have many competitors to force them to keep their costs down. So how do they increase their profits without reducing costs? Increase premiums.

Medica is one of the most inefficient companies I have ever seen. For example, nearly every year, I request that they sign me up for paperless statements – something that would save them money and be more convenient for me. But they have never done it. They refuse to update their system. In fact, I had to fax my request to them and they mailed me their response. Even in 2016, they don't use email.

I'm not the only one who has experienced the inefficiency of Medica firsthand. Nearly every health care provider I have visited in the past few years is constantly frustrated with Medica. They lose paperwork, don't call back when they say they will, and take months to process some claims. The number of internal problems would cause nearly any other corporation to go out of business. But Medica has a not-so-secret way of combating their inefficiency. Increase premiums.

Healthy Savings?

A prime example of Medica's horrible management is a program they launched a few years ago called "Healthy Savings."

I first found out about this program in a letter Medica sent me around the time Obamacare was enacted. The letter said Medica would no longer be providing me with a $20 monthly discount for my gym membership. It said I could save even more money with their new Healthy Savings program, which would give me discounts for making healthy shopping decisions.

That sounded OK since I make a point to buy healthy food – lots of fruits and vegetables, fresh (not frozen) meals, and food without preservatives. I typically more for these types of foods compared to the cheaper, less healthy options available. My grocery bills are typically in the range of $100 to $150, but I have never saved more than $2.50 using my Healthy Savings card. Most of the time, the cashier scans my card and I save $0.00. The Healthy Savings program has definitely has not made up for the $240 each year I am no longer reimbursed for my fitness center attendance. In fact, I don't think I've saved more than $20 total in the past five years.

The amount of money Medica has wasted by setting up this program would have caused most companies to go bankrupt. But it's not too hard to figure out their method of subsidizing such a massive failure. Increase premiums.

Conclusion

Most of this article was specific to the organizational disaster that is Medica. But Medica is a microcosm of a much larger problem – the health insurance industry. The lack of competition in the marketplace means there are several other insurance behemoths across the country raising premiums to keep their profits intact. The Affordable Health Care act needed to address this problem if it really was going to make health care more affordable.

Until the waste is cleaned out of the system and competition is introduced into the marketplace, insurance companies will continue to do the one thing they are good at. Increase premiums.

Home

Home November 9th

November 9th