2020 Stock Pick Review: FSLY

January 1, 2021 — by Per Christensson

In March 2020, the pandemic sent global stock markets into a downward spiral. After a few weeks of record volatility, it seemed there was no end in sight. A few months later, the US stock market finished the year at all-time highs.

In March 2020, the pandemic sent global stock markets into a downward spiral. After a few weeks of record volatility, it seemed there was no end in sight. A few months later, the US stock market finished the year at all-time highs.

Amidst all the volatility, there were clear winners in 2020. Most of the top performers were tech stocks related to the "work from home" lifestyle forced upon millions of employees worldwide. One of these companies was Fastly (FSLY).

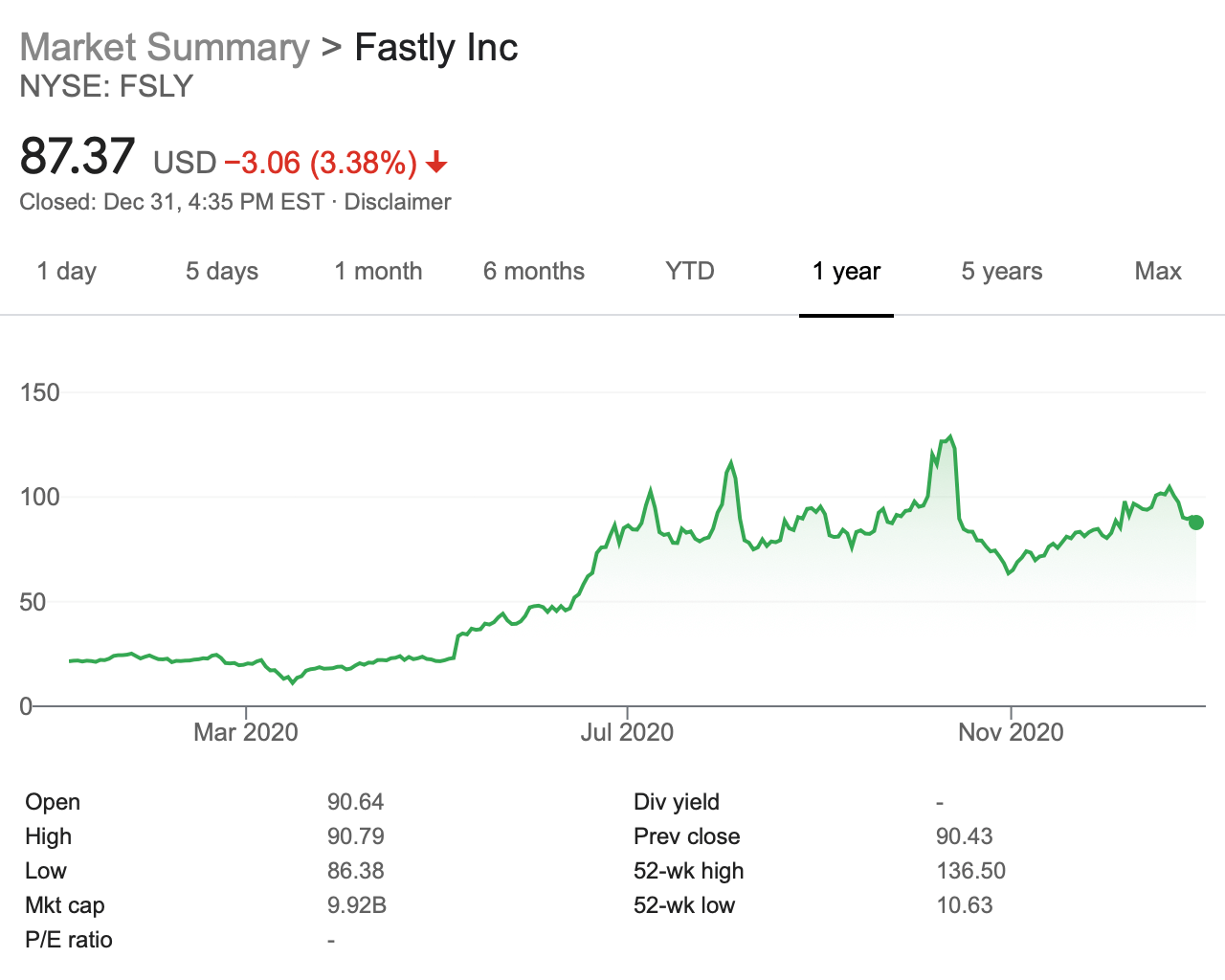

FSLY started the year at 20.07 and had an uneventful first two months. Then covid cause the Great Panic and FSLY hit its 52-week low of 10.63 on March 16. Seven months later, FSLY hit its 52-week high of 136.50, an increase of over 1,000%.

As a reminder, my criteria for a successful stock pick are:

- The one-year return (Jan 1 to Dec 31) must be positive.

- The one-year return must beat the S&P 500.

▶ FSLY's 2020 annual gain was 335.33%, which handily beat the 16.26% gain of the S&P 500. At its peak (136.50), FSLY was up 780.12% for the year. Because the return was positive and beat the S&P 500, FSLY was a successful stock pick.

When I chose FSLY as my 2020 stock pick, I did not expect a global pandemic. I chose Fastly because the company had exceptional content delivery technology and significant growth potential. While I couldn't foresee the pandemic's effect on Fastly's business, I remained confident in the company and bought more shares as the stock dropped. My lowest purchase price was 11.40 on March 16.

As FSLY skyrocketed in the following months, I held my shares. It was not until the stock eclipsed 100 that I sold my first lot. I bought more shares as the stock dropped down to the 60s and 70s. I sold FSLY four different times in 2020, each time over 100. I still own twice as many FSLY shares as I did one year ago because I believe in the company's long-term potential.

Home

Home October 31st

October 31st