PC.net 2020 Tech Stock Pick: FSLY

January 1, 2020 — by Per Christensson

Last January, I announced my 2019 stock pick — Western Digital (WDC). Before I choose a new one for 2020, let's see how WDC performed in 2019.

Last January, I announced my 2019 stock pick — Western Digital (WDC). Before I choose a new one for 2020, let's see how WDC performed in 2019.

The price of WDC on January 1, 2019 was 36.97. The stock hit its 2019 high of 65.31 on September 13, for a gain of 76.7%. It finished the year at 63.47 for a one-year return of 71.7%. WDC also has a healthy dividend, which started the year over 5% and is now at 3.15%, thanks to the higher stock price.

My criteria for a successful stock pick are simple:

- The one-year return (Jan 1 to Dec 31) must be positive.

- The one-year return must beat the S&P 500.

Based on these criteria, WDC was a successful stock pick for 2019, more than doubling the performance of the S&P, which was up 28.9%.

2020 Stock Pick

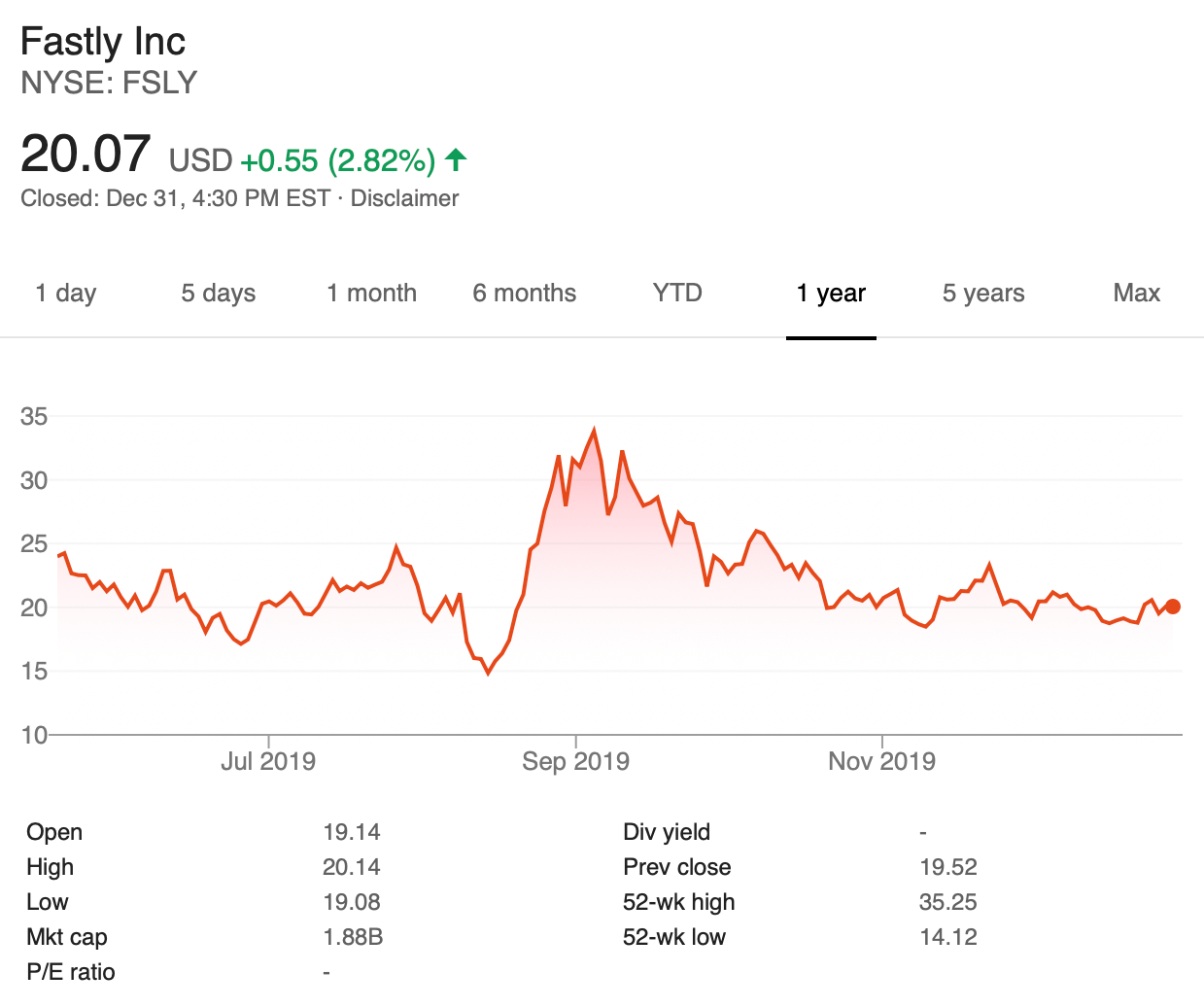

My stock pick for this year is... Fastly (FSLY). It is currently trading at $20.07 per share.

Fastly had its IPO in May last year, so it hasn't even had its one-year birthday as a publically traded company. Fastly is much smaller than Western Digital, so you can expect more volatility in the stock. In fact, it has already had a bit of a wild ride (see below). However, Fastly's relatively small size (~$2 billion market cap) means it has more opportunity for growth and a higher return.

What is Fastly?

Fastly is an "edge cloud platform" that provides content and computing power from dozens of locations around the world (see map). These locations comprise the "edge network" where content and computing power is delivered from a nearby location to users around the world.

Common applications of Fastly's technology include content delivery networks (CDNs), load balancing, and edge computing. These services allow businesses to provide their content (websites, video streaming, cloud-based apps, etc) to customers much faster than from a single location.

Why Fastly?

Fastly is one of several edge cloud platforms. Two notable competitors include the much larger Akamai (AKAM) with a market cap of $14 billion and the more comparable Cloudflare (NET) with a market cap of $5.1 billion. I use Akamai's CDN for my websites, and it has been extremely solid, with zero performance issues in the past two years. While I like Akamai, I see more opportunity for growth with Fastly. Fastly's edge computing service "Compute@Edge" looks especially promising, though I do think they could have chosen a better name.

I always choose my investments based on the risk-reward ratio. FSLY has more risk than WDC, but the reward is much greater. Similar to why I chose WDC last year, I think the downside risk to FSLY is limited, while the upside potential is high. Even a move from $20 to $30 is a 50% gain, which I think is reasonable for 2020. Based on the institutional investors who own FSLY, I don't expect the stock to drop below 15.

Remember, nothing is guaranteed in the stock market. Maybe the entire stock market will have a significant drop in 2020, taking most of the tech stocks with it. Or maybe WDC will perform even better this year, like my 2018 stock pick, AMD, which was up 148% in 2019. The point is this article is an opinion, not professional investment advice. Always do your own research before buying stocks. Happy 2020!

Home

Home December 21st

December 21st