PC.net 2019 Tech Stock Pick: WDC

January 1, 2019 — by Per Christensson

I have been investing ever since I was old enough to open a Datek Online account while I was still in high school. I've learned a lot in the past 20 years. While my early years investing were pretty painful, I eventually developed a strategy that has worked well. Several of my friends ask me for investment advice, which I'm happy to provide, with the qualifier that nothing is guaranteed when it comes to the stock market.

I have been investing ever since I was old enough to open a Datek Online account while I was still in high school. I've learned a lot in the past 20 years. While my early years investing were pretty painful, I eventually developed a strategy that has worked well. Several of my friends ask me for investment advice, which I'm happy to provide, with the qualifier that nothing is guaranteed when it comes to the stock market.

Recently, I've enjoyed making a stock pick at the beginning of each year. I choose a single stock that I think will do well in the next 12 months. Last year, I chose AMD. It started the year at 10.98 and hit a high of 34.14 in September, for a gain of 311%. Like a lot of high-flying tech stocks, AMD came back to earth in the last quarter of 2018, but it still finished at 18.46, a 68% gain.

This year, for the first time, I've decided to share my annual stock pick on PC.net. For 2019, the stock is Western Digital (ticker symbol: WDC). If you're not familiar with Western Digital, its primary business is producing data storage devices, such as HDDs and SSDs.

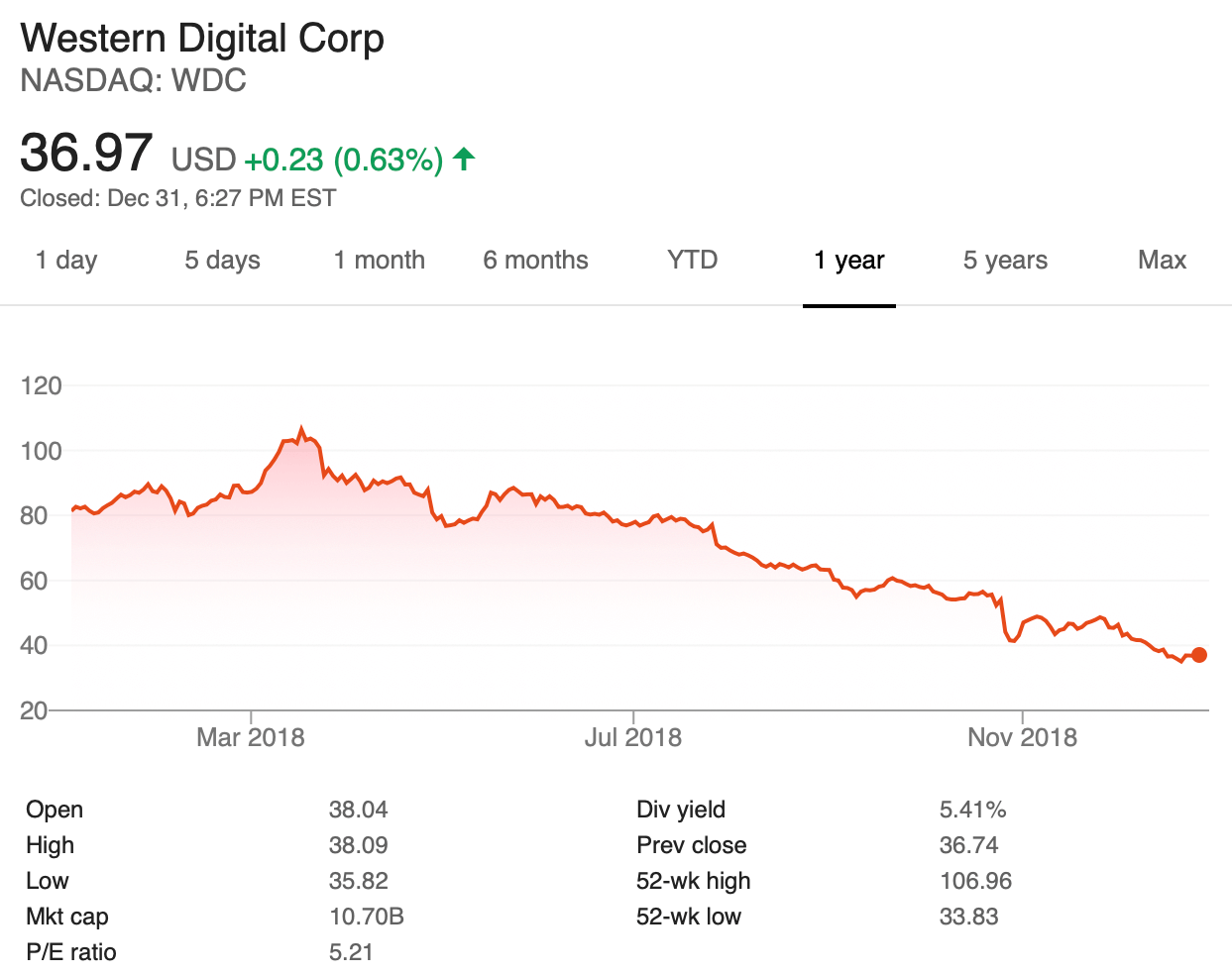

Like AMD, WDC has fallen a lot over the past few months. The stock is heavily oversold, IMO. While consumer hard drive demand has fallen and prices of flash storage have declined, I see a lot of upside for Western Digital this year. Enterprise storage investment is still increasing at a rapid rate and flash storage (NAND) pricing is cyclical and will eventually recover

If there is one constant among all the cloud-based services, it is the need for storage – and lots of it. While Western Digital isn't the only player in the enterprise storage market (I also like Seagate), I think Western Digital is the best value right now. The current stock price of WDC is 36.97, which gives the company a low P/E ratio of 5.21 and a nice dividend yield of 5.41%. Those numbers combined with the potential upside and limited downside over the next 12 months makes the risk/reward of WDC the best of any stock I can think of right now.

So there you have it: my 2019 stock pick is WDC. While it's currently trading at a historically low price of 36.97, I wouldn't mind if it dropped a little further, so I can buy more shares at an even better price. I'm guessing that by the end of 2019, the price of WDC will be significantly higher.

Important: This article is an opinion and should not be considered professional investment advice. No matter whose advice you decide to listen to, remember: nothing in the stock market is guaranteed.

Home

Home December 7th

December 7th