The R&D Tax Law Crushing Software Developers

August 2, 2024 — by Per Christensson

You squeak out a $10,000 profit, so your business owes about 20%, or $2,000 in taxes. Right? Wrong. Under the current tax law, you owe $332,876 in taxes. Yes, that is correct. Your tax rate is over 33,000%.

How is this possible?

The current United States tax law states that research and development (R&D) costs must be amortized rather than expensed. It changed in tax year 2022 when Congress failed to pass an updated law. For the past two years, small businesses have been forced to amortize R&D expenses over five years instead of expensing them. The IRS classifies software programming as "development," which includes developer wages.

The example above uses the following numbers:

- Revenue: $1,000,000

- R&D Costs: $900,000

- Other Expenses: $90,000

- Profit: $10,000

According to the current tax law, software developers must "add back" R&D costs and amortize the expenses over five years. Technically, it's six years since they can only deduct 10% in the first year, then 20%, 20%, 20%, 20%, and 10% in the final year. Under the current tax law, the calculation changes to this:

- Revenue: $1,000,000

- Deductible R&D Costs: $90,000

- Other Expenses: $90,000

- Profit: $820,000

As a small business owner, your business profit flows through to your personal taxes, so you pay the tax at your personal tax rate. In Minnesota (my home state), your tax would be calculated like this:

- Income: $820,000

- Federal tax: $258,608

- MN state tax: $74,268

- Total tax: $332,876

While the numbers above are only examples, they are typical of small software companies, like the one I run (Sharpened Productions). Unlike large corporations that have the financial capacity to absorb these costs over time, we don't have the capacity to pay hundreds of thousands of dollars in tax on small profits. The current tax law is forcing us out of business.

▶ Imagine running a small restaurant and not being to expense the wages you pay your cooks, servers, and managers. You would be stuck paying taxes far higher than your business's profit. This is exactly what software development companies are facing right now.

Possible Tax Law Changes

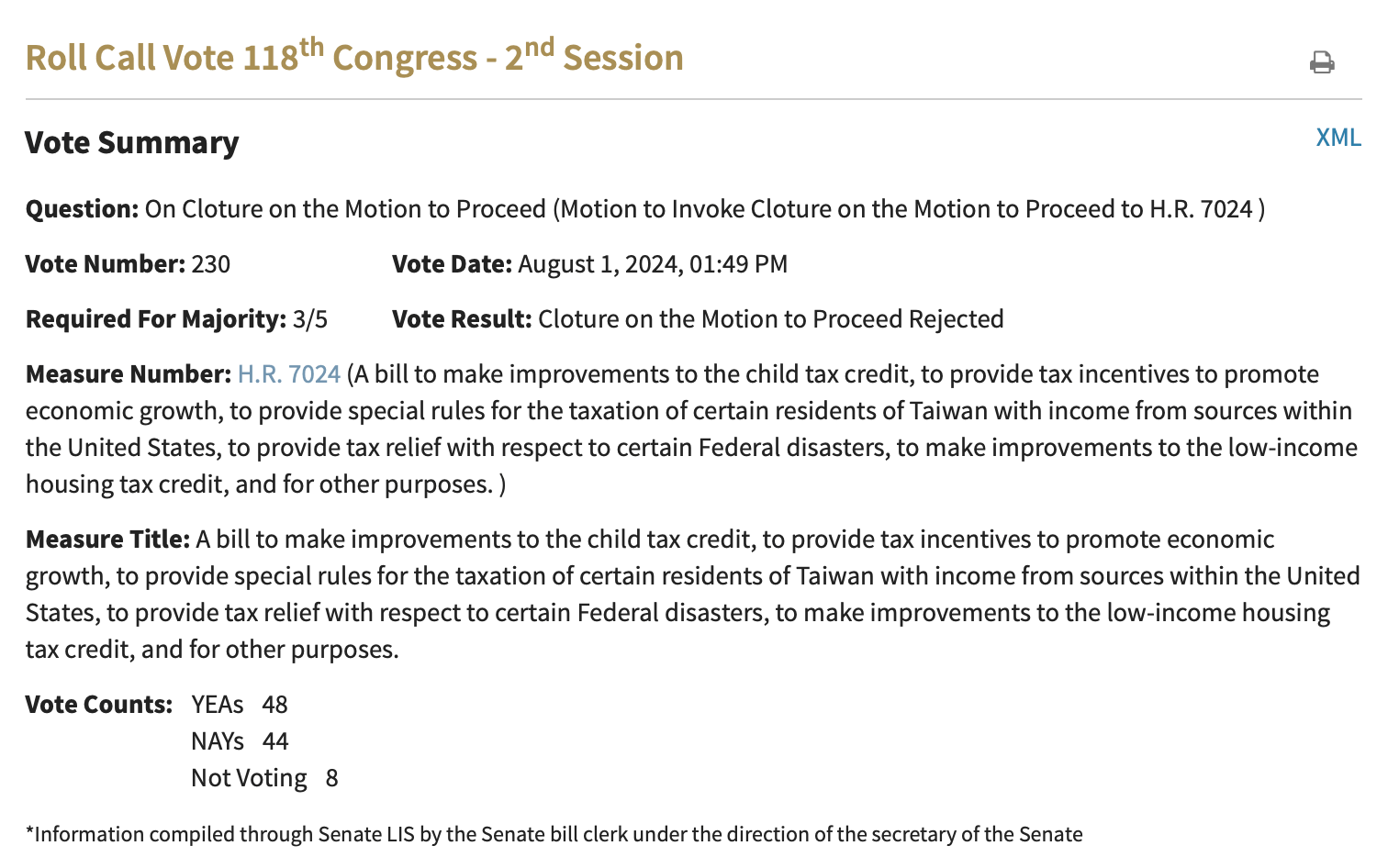

Yesterday, on August 1, 2024, the Senate voted on H.R. 7024 (Tax Relief for American Families and Workers Act of 2024). This tax bill, which passed the House by a significant majority (357-70) on January 31, would have reinstated R&D expensing. But it failed to pass (see the vote below).

I have been running Sharpened Productions for over 20 years and have never experienced such a devastating blow from the United States government. My accountant said he has never seen anything like it in his career. I even flew to the U.S. Capitol last September to speak to one of my representatives about the matter, and he said it was ridiculous. But still, Congress has not passed a new tax law.

Yesterday, Congress had a chance to rectify the disastrous situation, but they failed. The United States, a country that once prided itself on being a leader in research and development, is destroying R&D and forcing small software developers out of business. It is crucial for policymakers to pass an updated tax law before the filing extension deadline on September 15, 2024.

Home

Home July 26th

July 26th